How to Choose the Best Interval Funds

As traditional investments wobble under the weight of economic and interest rate uncertainty, interval funds stand out for their resilience and potential for stable returns. These funds can serve as a prudent replacement for bond funds, offering investors a haven with lower volatility. With FastTrack, investors gain a panoramic view of the interval funds landscape, ensuring they’re well-equipped to make informed decisions.

Selecting the Best Interval Funds Made Easy

Choosing the right interval fund can be a daunting task given the plethora of options available. FastTrack simplifies this process with its comprehensive database and intuitive interface. With access to detailed statistics on every available interval fund, our platform helps you sift through the noise to pinpoint the best funds that align with your investment goals.

Private Debt’s Remarkable Growth

The leap from $280 billion to $1.5 trillion in assets under management from 2007 to $1.5 trillion in 2023 signifies private debt’s ascension as a dominant force in the investment world. Powerhouses like KKR and Apollo are now steering a significant portion of their assets towards these markets. With FastTrack, this once-opaque realm is decoded, presenting opportunities for astute investing through detailed statistics and fund comparisons.

What is an interval fund?

Interval funds are a type of investment fund that combine features of both open-end and closed-end funds. They are structured to offer investors liquidity through periodic repurchase offers by the fund, typically on a quarterly basis. These repurchase offers usually range from 5% to 25% of the fund’s shares at net asset value (NAV). This mechanism provides investors with scheduled opportunities to sell their shares back to the fund, which can make interval funds a more accessible option for those seeking investment opportunities with less liquidity than open-end mutual funds.

Private Debt Fund Risks

While interval funds can offer potential for higher returns by investing in a range of assets, including those not typically found in daily liquidity funds, they also carry certain risks. The investments held within interval funds often involve assets that are less liquid and more complex, which can lead to higher risk in comparison to more traditional investments. Additionally, the limited liquidity options mean that investors cannot always withdraw their money on demand but must wait for the specified repurchase intervals. This can pose a risk if an investor needs to liquidate their position quickly and the repurchase window is not open. It’s crucial for investors to carefully weigh these factors against the potential benefits when considering interval funds as part of their investment strategy.

Mastering Risk with In-Depth Analysis

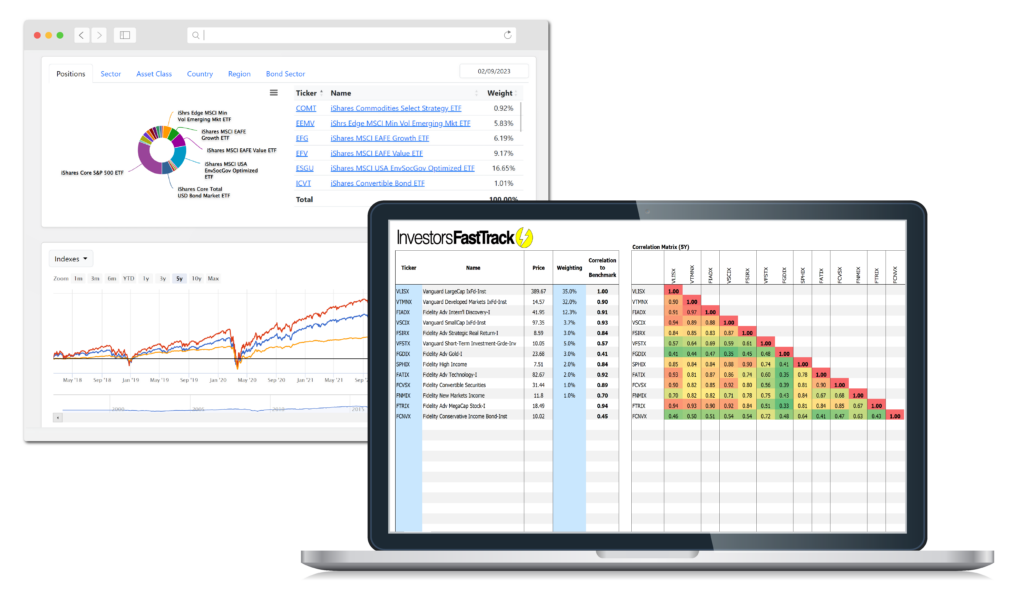

Understanding the risk profile of your investments is paramount. FastTrack not only presents the performance metrics of funds but also contextualizes them within the broader market statistics. Our dynamic reports, charts, and heatmaps offer a granular view of risk, allowing you to assess and compare the relative safety of each fund, ensuring you make decisions with eyes wide open.

Benchmarking Against the Market’s Best

How do your chosen interval funds stack up against the market’s top-performing ETFs and open-ended mutual funds? FastTrack provides direct comparisons, enabling you to weigh all investment against similarly performing sercurites such as ETFs, mutual funds, stocks, indexes, and custom portfolios. You can use FastTrack and this information to determine the suitability of interval fund for your portfolio.

Portfolio Construction and Backtesting

Building a diversified portfolio that can withstand market fluctuations is crucial. FastTrack excels in this arena, offering tools to construct and backtest portfolios that include interval funds alongside stocks, ETFs, and open-ended funds. Whether you’re looking to incorporate interval funds for their low volatility or to hedge against market downturns, our platform equips you with the resources to craft a robust investment portfolio.

The Impact of Interval Funds on Your Portfolio

FastTrack doesn’t just allow you to add interval funds into your portfolio mix; it illuminates how they influence your overall investment strategy. By understanding the role interval funds play, you can make informed decisions about allocation, balancing potential returns with an acceptable level of risk. Our platform’s insights help ensure that every move you make is calibrated to the unique contours of your financial landscape.

The Investment Horizon: Preparing for What’s Next with FastTrack

In a world where economic forecasts suggest a soft landing, the strategic selection of interval funds could define the astuteness of an investor. FastTrack empowers you to anticipate and capitalize on economic trends, providing a robust platform for choosing any and all funds that align with your investment objectives. As the market evolves, so does your strategy with FastTrack, ensuring that you’re always a step ahead.

Ready to take your next step?

Unlock unparalleled interval fund insights with our ranking, charting, visualization, and data tools . Elevate your decision-making and captivate clients. Sign up now for a FREE trial. No credit card required.